Cost of Living – Budgeting

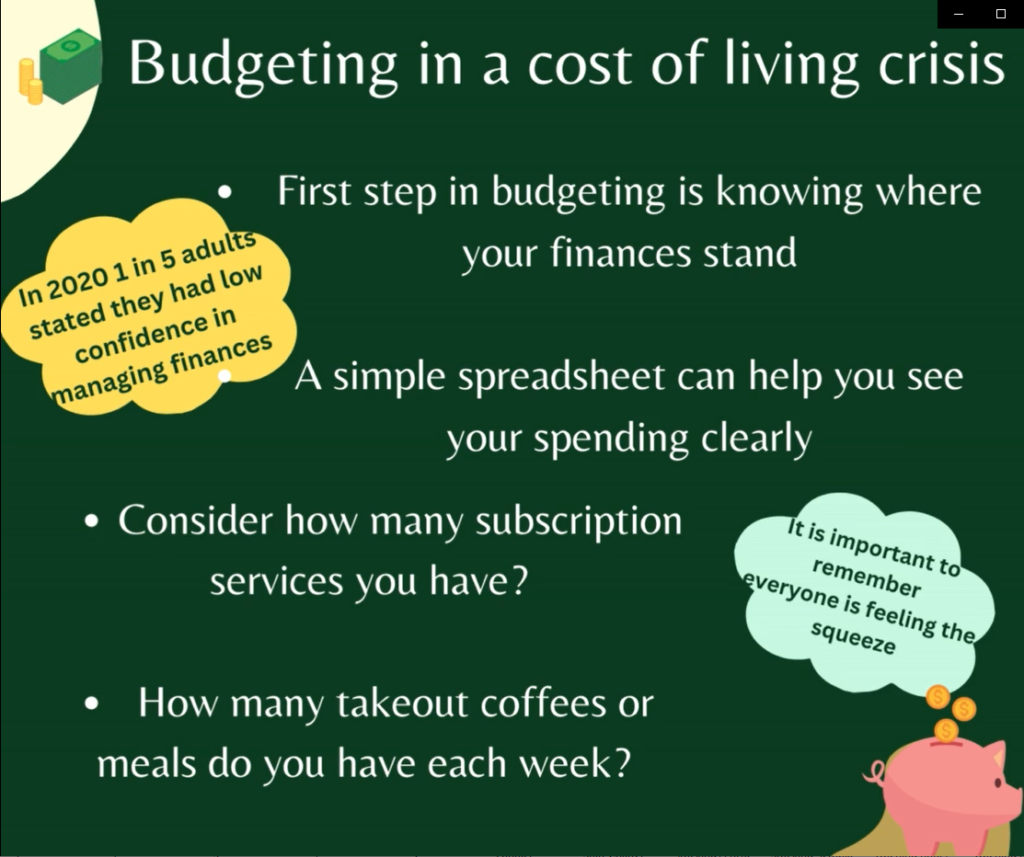

When facing financial hardship, it is important to consider the costs that can be reduced or managed. There has been a national push to help educate more people in financial literacy and budgeting. As recently as 2020, one in five adults stated they had low confidence or knowledge in managing financial matters.[1] A budget is often the most important tool in dealing with the rising cost of living. This can be a daunting task but is also the first step in taking control of your finances.

There are a number of great resources out there to help including:

- The Irish League of Credit Unions (ILCU) have created a page to compile budgeting tips, which can be found at https://www.creditunion.ie/cost-of-living/budgeting/

- A list of apps that may be useful can be found at https://www.creditunion.ie/blog/7-tools-to-manage-a-household-budget/. Please be aware that some of these are subscription-based!

- A great online budget builder which can be found at https://www.moneyhelper.org.uk/en/everyday-money/budgeting/budget-planner.

- The debt advice charity, StepChange, has a very useful page about making a budget with a thorough spreadsheet you can easily download and edit available at https://www.stepchange.org/debt-info/how-to-make-a-budget.aspx

As a Credit Union, we encourage our members to empower themselves to do so. If you would prefer to make a paper-based budget, please call in. We will be able to provide you with a copy of a general budget for your own use.

It’s important to remember that everyone is feeling the squeeze due to the cost of living at the time. One of the many things that can hold people back from accessing help is often feeling embarrassed or ashamed to talk about the fact that they are struggling. In 2020, more than half of UK adults said they wouldn’t feel comfortable discussing their finances.[2] There is still a lot of stigma surrounding discussions about debt and money. In Lurgan Credit Union, we believe that it is of utmost importance to treat our members with respect, empathy and consideration. If you are struggling to meet your repayments, please get in touch with our Credit Control as soon as possible. Early contact is an essential part of managing your finances and we encourage all our members to do so.

We would urge our members to contact us with any concerns they may have and we will do our best to help. The credit union movement was founded on helping your neighbours and at Lurgan Credit Union we take this very seriously.

Every year, we make donations to local community groups through our PETPAD scheme. If this is something you would be interested in applying for, please see further information on https://www.lurgancu.com/supporting-our-community/

This cost of living series aims to help you build your financial confidence. You’ll find insights, tips and suggestion to help you feel more knowledgeable about managing your money, as well as jargon free answers to some basic financial questions. This information can also be found on the Credit Union money on your mind series. The content within this series is aimed to provide general guidance and information only. It does not represent financial advice.